Gold and Silver Prices Face Historic Shock as $5.9 Trillion Market Value Vanishes in One Hour

A Sudden Shock to Global Gold and Silver Markets: Understand What We Do.

Global gold and silver markets experienced an unexpected and historic shock as prices dropped sharply in a very short time.

In just one hour, nearly $5.9 trillion in market value was wiped out, creating panic among investors worldwide.

According to experts, this loss is equal to the combined economies of the United Kingdom and France.

Such a massive decline in such a short period is rare in financial history.

However, analysts also believe that this crash may open a new opportunity for long-term investors.

What Happened to Gold and Silver Prices?

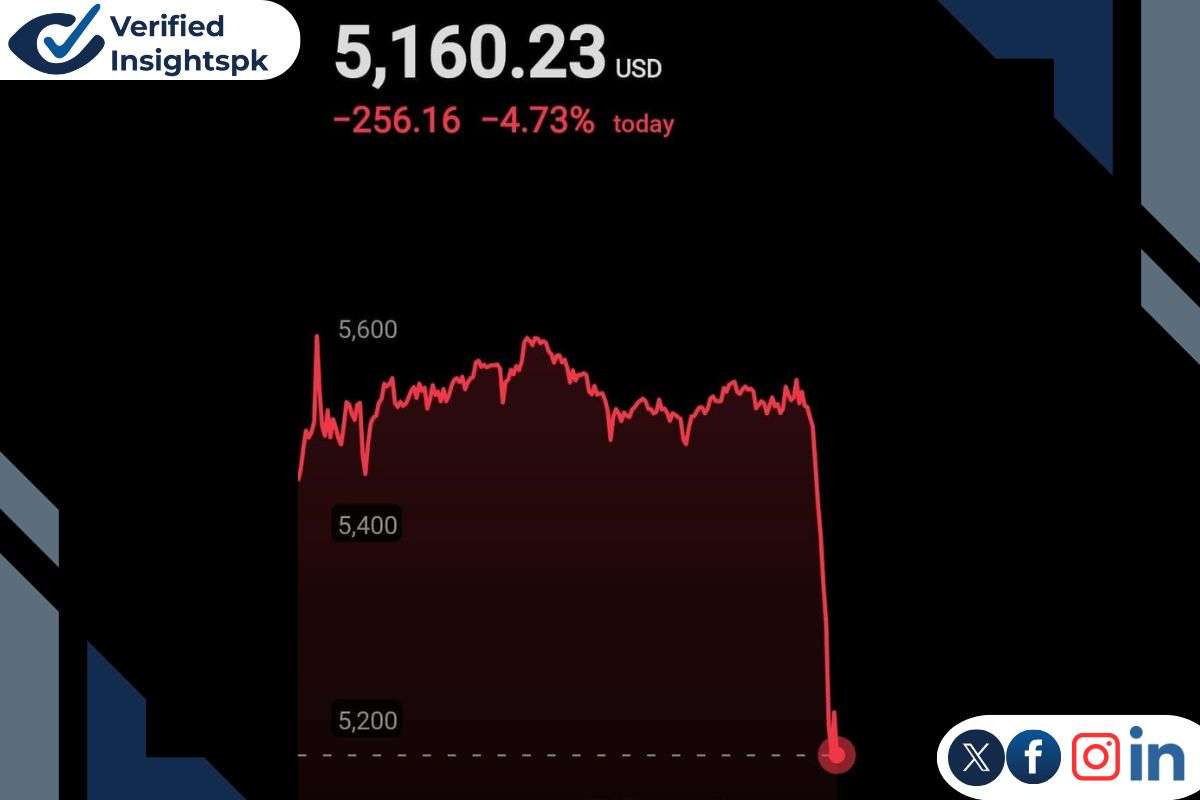

Gold and silver prices were trading at record-high levels, touching the sky in recent weeks.

Suddenly, markets experienced a violent correction.

Prices fell rapidly, surprising traders, investors, and analysts alike.

The speed and size of the fall made this event far more serious than normal market volatility.

Experts say this was not a routine price adjustment.

$5.9 Trillion Loss: Why This Event Is Unprecedented

Financial analysts describe this crash as much larger than a typical “6-sigma event.”

In simple words, it means this drop was extremely rare and statistically unusual.

Why this matters:

- The loss happened within one hour

- The scale was trillions of dollars

- Multiple markets were affected at once

Such events are rarely seen in standard trading cycles.

What Caused This Massive Market Crash?

According to financial experts, this shock did not come from outside news. Instead, it originated inside the financial system itself.

Key internal factors include:

1. Sudden Deleveraging

Large investors quickly reduced their borrowed positions.

This created heavy selling pressure.

2. Continuous Margin Calls

As prices dropped, brokers demanded more funds.

Many investors were forced to sell assets.

3. Sharp Fall in Collateral Value

Gold and silver are often used as collateral.

When their value dropped, it triggered more forced selling.

4. Forced Liquidation

Automated systems sold assets to limit losses.

This increased the speed of the crash.

Together, these factors created a chain reaction.

Why This Was Not a Normal Market Fluctuation

Analysts agree that this was not a regular up-and-down cycle. It was a system-driven shock, where one problem triggered another.

Normally, markets adjust slowly. This time, prices collapsed within minutes, not days. That is why experts are calling it one of the sharpest financial jolts in recent history.

What This Event Reveals About the Global Financial System

Economic observers say this crash highlights the fragility of the global financial system.

Key lessons:

- Markets are highly interconnected

- Automated trading increases speed and risk

- Liquidity can disappear very quickly

- Confidence plays a major role in price stability

This event proves that uncertainty remains high in global markets.

Impact on Gold and Silver Investors

In the short term, investors felt fear and confusion. Many panic sellers exited the market.

However, experienced analysts suggest a different perspective. On the other side, people have invested 3.2 trillion after knowing the prices got a great fall. Well the about the investment, the last 72 hours. well the investment figure is not verified.

Is This the Right Time to Buy Gold and Silver?

Financial experts strongly believe that this correction may create an opportunity.

Why experts say “do not panic”:

- Gold and silver remain long-term safe assets

- Prices corrected after extreme highs

- Forced selling usually creates undervalued levels

- Demand for precious metals remains strong

According to analysts, the real buying phase may start now. As we have mentioned above, investors have already taken this massive market crash as an opportunity to invest.

Why Gold and Silver Still Matter in Uncertain Times

Gold and silver have always been considered safe-haven assets.

They protect against:

- Inflation

- Currency weakness

- Economic instability

- Global uncertainty

Even after this shock, their long-term importance remains unchanged.

Verified Insights PK Viewpoint

At Verified Insights PK, we believe this event is not the end of gold and silver. Instead, it marks a reset in overheated markets.

History shows that:

- Sharp crashes often follow sharp rallies

- Strong assets recover over time

- Smart investors focus on value, not fear

This correction should be viewed with analysis, not panic.

What Should Investors Do Now?

Experts recommend:

- Avoid emotional decisions

- Study price trends carefully

- Focus on long-term goals

- Do not follow panic selling

Timing the market perfectly is difficult.

However, buying during fear has historically rewarded investors.

Conclusion

The sudden fall in gold and silver prices shocked global markets. The loss of $5.9 trillion in one hour is a rare financial event.

Yet, experts agree that:

- The crash was system-driven

- Fundamentals remain strong

- Opportunities often emerge after fear

For investors who understand market cycles, this may be the beginning of a new opportunity, not the end.

However, markets fall fast, but value builds slowly. Gold and silver have survived centuries of crises, and this one may be no different. For now, keep in mind that

- Market pauses are temporary.

- Price discovery takes time after major shocks.

- Calm observation is better than rushed decisions.

FAQs

1. Why did gold and silver prices fall suddenly?

Gold and silver prices fell due to internal market pressure, not external news.

Experts say sudden deleveraging, margin calls, and forced selling caused the sharp drop.

2. How big was the loss in the gold and silver market?

Around $5.9 trillion in market value disappeared within one hour.

This loss is equal to the combined economies of the UK and France.

3. Is this type of market crash common?

No.

Analysts say this crash was far more extreme than normal market fluctuations and is rare in financial history.

4. Was this a “6-sigma event”?

Experts believe this crash was even more unusual than a typical 6-sigma event, making it extremely rare and unexpected.

5. Did global news or politics cause this crash?

No direct global news triggered this fall.

The shock came from inside the financial system, including automated selling and liquidity pressure.

6. Can gold and silver prices recover after this crash?

Yes.

Historically, gold and silver have recovered after sharp corrections, especially when the crash is technical in nature.

7. Is it safe to invest in gold and silver now?

Experts suggest this may be a better buying opportunity rather than a risk.

However, investors should act carefully and focus on long-term goals.

8. Should investors panic and sell gold or silver?

No.

Panic selling often leads to losses.

Experts advise staying calm and avoiding emotional decisions.

9. Why do experts say the real buying time has started now?

Because prices corrected after extreme highs.

Forced selling often pushes prices below fair value, creating opportunities for smart investors.

10. Does this crash mean gold and silver are no longer safe assets?

No.

Gold and silver remain safe-haven assets during inflation, currency weakness, and economic uncertainty.

11. What lesson does this crash teach investors?

The main lesson is that markets are highly sensitive and interconnected.

Understanding risk and staying informed is essential.

12. Will gold and silver prices remain volatile?

Short-term volatility may continue. However, long-term trends depend on global economic conditions and investor confidence.

13. Should beginners invest in gold after this crash?

Beginners should:

- Learn market basics

- Avoid rushing decisions

- Consider small, gradual investments

- Seek professional advice if needed

14. Why is gold still important in global finance?

Gold protects against:

- Inflation

- Currency devaluation

- Economic instability

That is why it remains valuable worldwide.

15. Has gold and silver trading stopped in Pakistan after the price crash?

Yes.

After the sudden fall in gold and silver prices, buying and selling have completely stopped across Pakistan.

16. Is there any official gold or silver rate in Pakistan right now?

No.

At this moment, there is no official gold or silver rate in Pakistan due to extreme uncertainty in the market.

17. Why was gold and silver trading suddenly suspended in Pakistan?

According to a representative of a traders’ association, the situation changed within moments.

Prices became unstable, forcing traders to halt all transactions.

18. Did the market shutdown happen nationwide?

Yes.

The shutdown affected gold and silver markets across Pakistan, not just one city.

19. When will gold and silver trading resume in Pakistan?

Traders say the situation may become clearer when markets open tomorrow morning.

Only then will it be possible to estimate where prices have settled.

20. Is it certain that trading will resume tomorrow?

No.

Based on current conditions, there is a strong possibility that gold and silver trading may remain closed tomorrow as well, but nothing is confirmed yet.

21. Why do traders stop doing business when prices fall sharply?

When prices change too fast:

- Loss risk increases

- Rates cannot be fixed

- Market confidence drops

To avoid heavy losses, traders pause trading until stability returns.

22. What does this situation mean for buyers in Pakistan?

Buyers are advised to:

- Stay patient

- Avoid panic purchases

- Wait for official rates to return

Once the market stabilizes, better clarity will be available.

23. How common is a complete market shutdown like this?

Such shutdowns are very rare and usually happen only during extreme market shocks.

Track Live Gold and Silver Rates on Verified Insights PK

Stay informed with our Live Gold and Silver Rate page on Verified Insights PK, where prices are updated in real time. We provide interactive graphs for gold and silver, helping you clearly see price trends and sudden market changes. You can track new price movements, daily fluctuations, and market direction with ease.

Whether you are an investor or a buyer, our live charts help you make confident and timely decisions.

Visit our Live Gold and Silver Rates page now and stay ahead of the market.